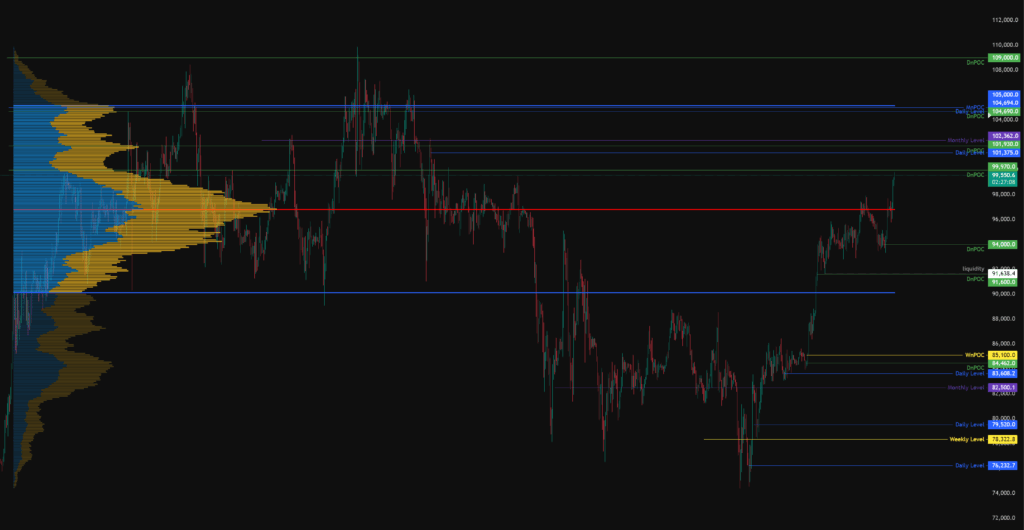

Looking at a higher time frame view of the Bitcoin chart we can see that price has now claimed the larger range POC. Taking in to account range theory and market context we can be expecting a move up towards the value area high area of around the $105,000 area. There are of course areas of resistance in between to be aware of which we will cover in our daily plan below.

Todays levels of support where price may, or may not give a reaction are:

- 94,000 – dNPOC (Daily Naked Point of Control) in confluence with the aVWAP.

- 91,600 – dNPOC (Daily Naked Point of Control) in confluence with liquidity on the 24th April low.

- 85,100 to 83,600 – Zone containing wNPOC (Weekly Naked Point of Control), dNPOC (Daily Naked Point of Control) and Daily Level and 0.618 fib level.

- 82,500 – Monthly level, 0.66 fib and area of liquidity.

Todays levels of Resistance where price may, or may not give a reaction are:

- 102,362 – Monthly level, daily level and naked point of control.

- 104,694 – Monthly naked point of control, daily level, range value area high.

News events to be aware of:

- 13:30 GMT – Jobless Data.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position