Taking a higher time frame view, we can see the ES is still in a bullish uptrend since the lows which were put in on the 7th April.

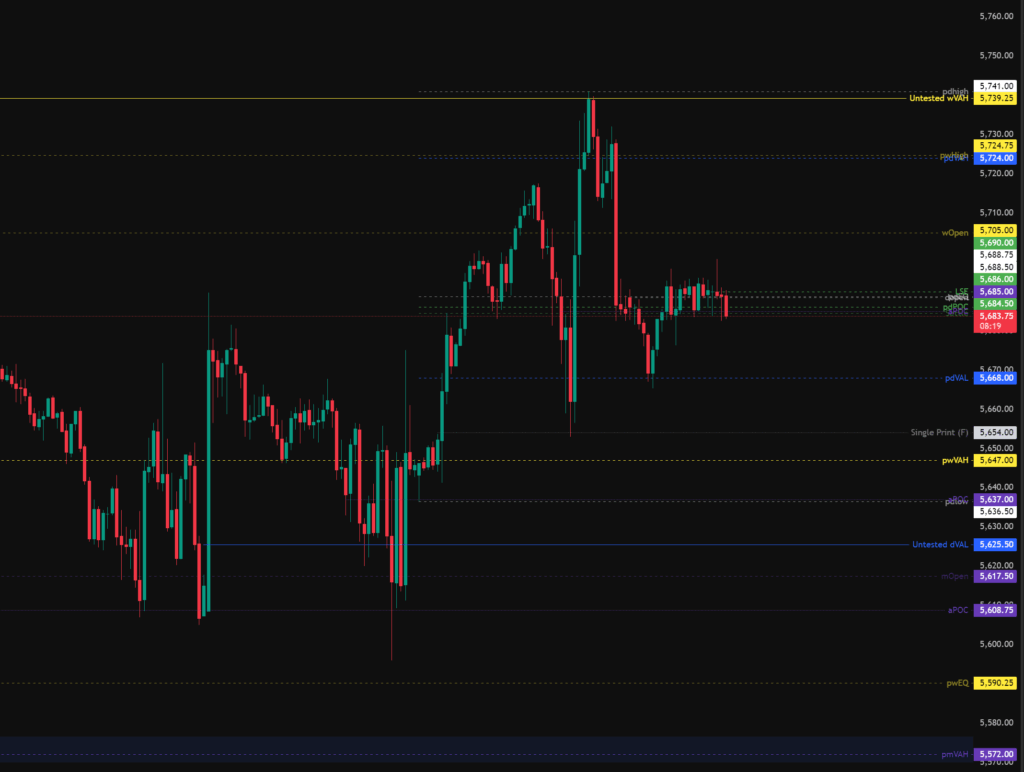

Yesterday ES gave a nice reaction at the untested weekly VAH which was a level of resistance given in yesterday’s S&P 500 technical analysis report.

Given the overall context it makes sense to allow the longs to run longer than the shorts until we have a clear change in market structure.

Today being Friday the focus should be on taking only high probability A+ setups and capital preservation.

Trading Plan

The monthly opened in the upper quartile of the previous months range, therefore statistically speaking a new monthly high could be expected this month.

The weekly opened in the upper quartile of the previous weeks range, therefore statistically speaking a new weekly high could be expected this week which happened yesterday.

On the daily time frame, price opened within previous day balance and the previous day VAL has already been tested.

Todays levels of support where price may, or may not give a reaction are:

- 5,647 – Previous week value area high, 0.66 retracement.

- 5,625 – Untested daily value area low, 0.786 fib retracement.

- 5,510 – Untested daily value.

Todays levels of Resistance where price may, or may not give a reaction are:

- 5,741 – pdHigh sweep, tested weekly value.

News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.