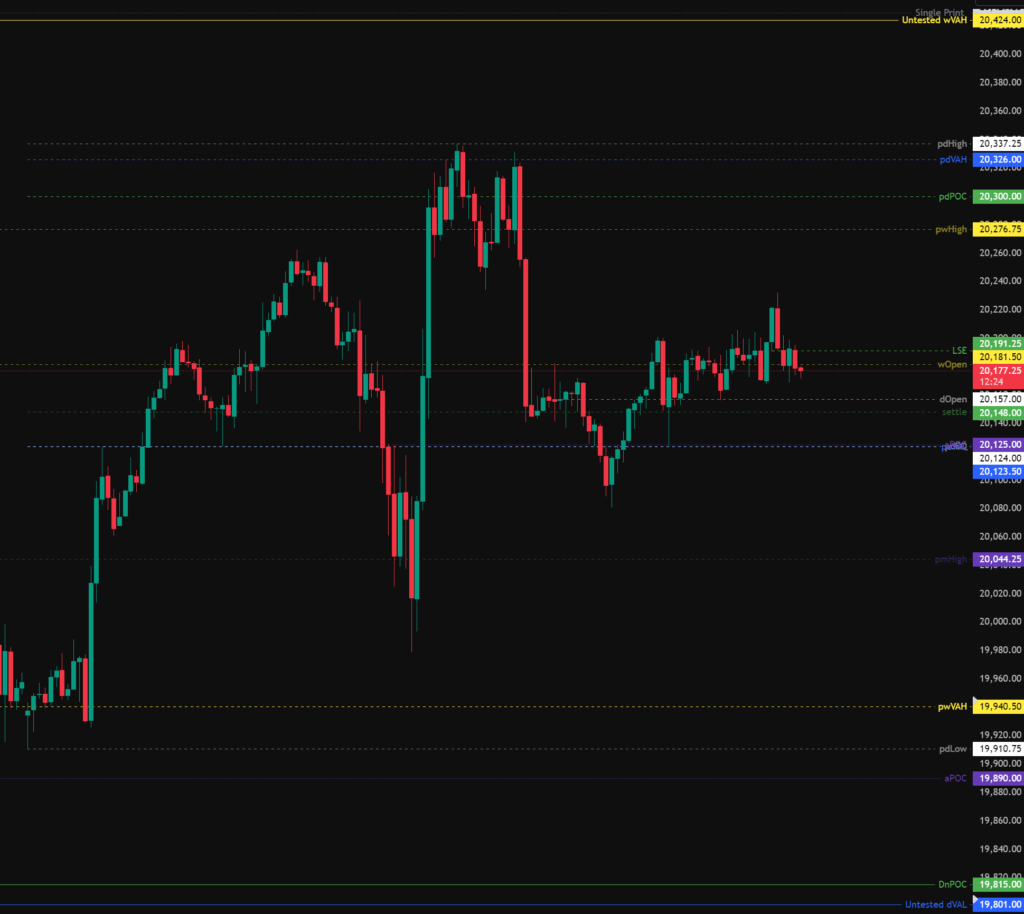

Just like the ES, Nasdaq is still in bullish uptrend with no signs of weakness. Given the context, just like with the ES we should be putting more weight on long trades.

The Nasdaq had a nice rejection at the untested monthly value level given in yesterdays Nasdaq technical analysis report.

Trading Plan

The weekly opened in the upper quartile of the previous weeks range, therefore statistically speaking a new weekly high could be expected this week – A new weekly high was made yesterday so this statistic has now been completed.

On the daily time frame, price opened within previous day balance and has already tested the pdVAL in confluence with the pdEQ.

Todays levels of support where price may, or may not give a reaction are:

- 19,910 – pwVAH, pdLow, 0.66 fib. aPOC.

- 19,801 – Untested value, naked point of control.

- 19,594 – Untested Value, Support Resistance Zone.

- 19,500 – Naked daily POC, pmPOC (Previous Month Point of Control), PwPOC (Previous Week Point of Control), 0.66 Fib.

Todays levels of Resistance where price may, or may not give a reaction are:

- 20,326 – pdVAH, pdHigh sweep taking liquidity.

- 20,424 – Untested weekly value area high, single print, aPOC.

News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.