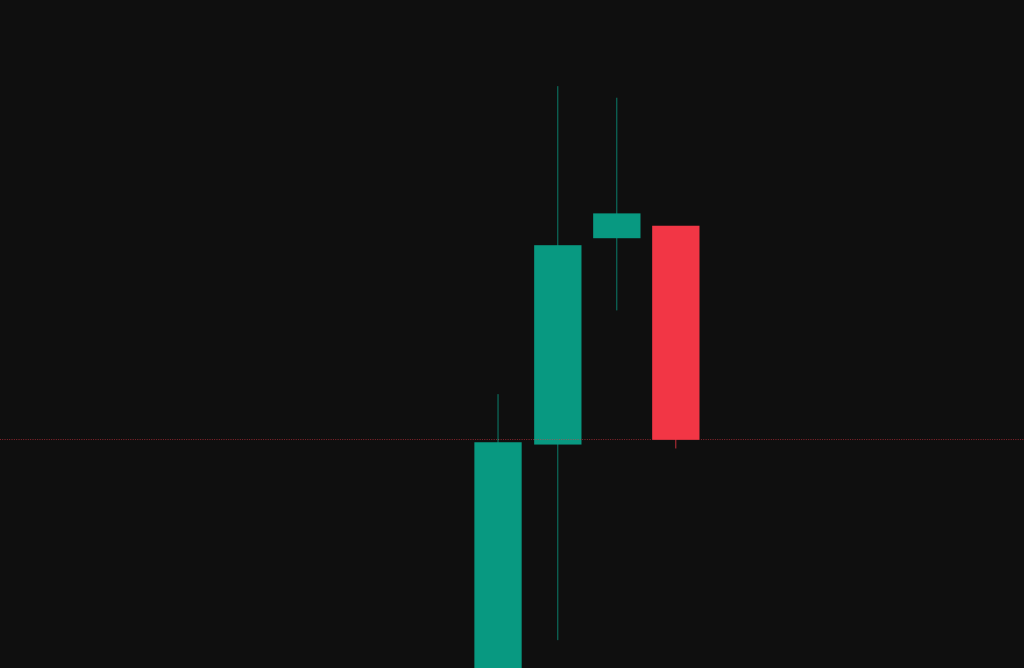

Yesterday we saw an inside day on the ES, the NY session was rangebound with no large trending moves like we have seen in the prior days. Today, the ES has opened with a small gap down and a wickless bearish candle with is worth noting as a potential target.

Today we have a lot of data coming out of the US which means we need very tight risk management and to be aware levels of support and resistance may not hold as we would expect during normal trading conditions.

Trading Plan

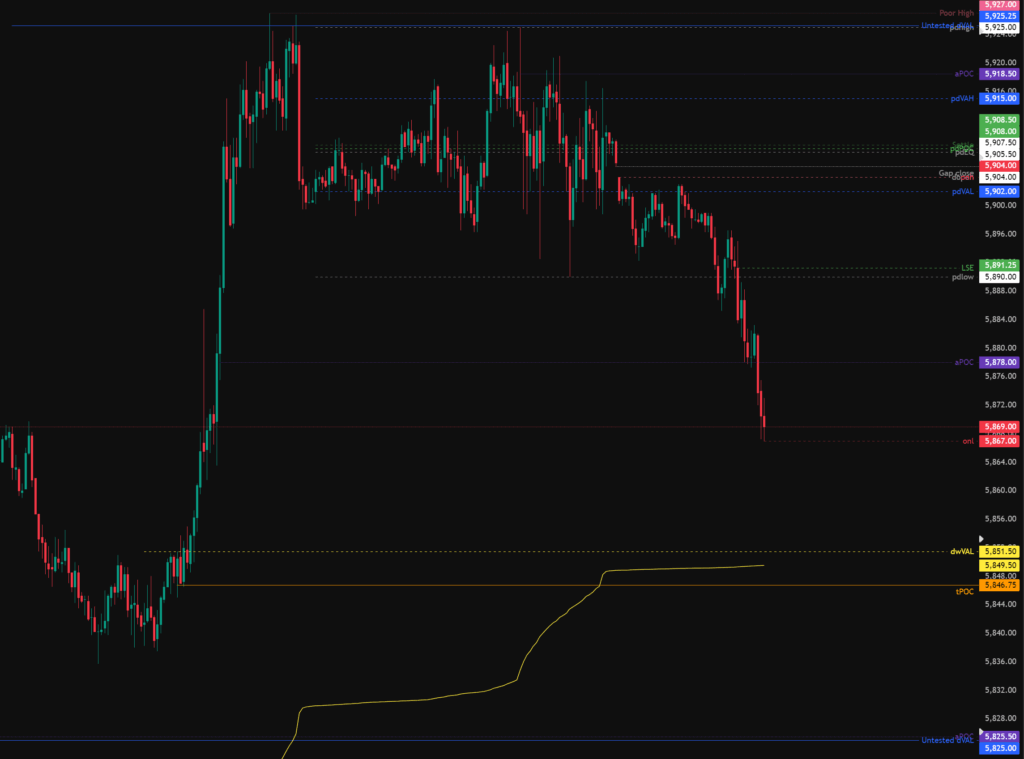

London has open bearish today on the S&P 500 and we are seeing the market clearly trending lower.

We are now trading below the pdLow and filling the inefficiencies from the trending move up on Tuesday.

Todays levels of support on the S&P 500 where price may, or may not give a reaction are:

- 5,850 – Current week VAL, anchored vWAP, naked time point of control, 0.618 fib retracement.

- 5,825 – Untested VAL & aPOC.

- 5,773 – Previous month high backtest & Single print fill.

Todays levels of Resistance on the S&P 500 where price may, or may not give a reaction are:

- 5,908 – Settlement, pdEQ, pdPOC & Gap fill.

- 5,927 – Untested daily value, pdHigh, Poor high repair.

High Impact News events to be aware of:

- 13:30 GMT – Jobless Claims, Retail Sales, PPI.

- 13:40 GMT – FED Chair Powell Speech

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.