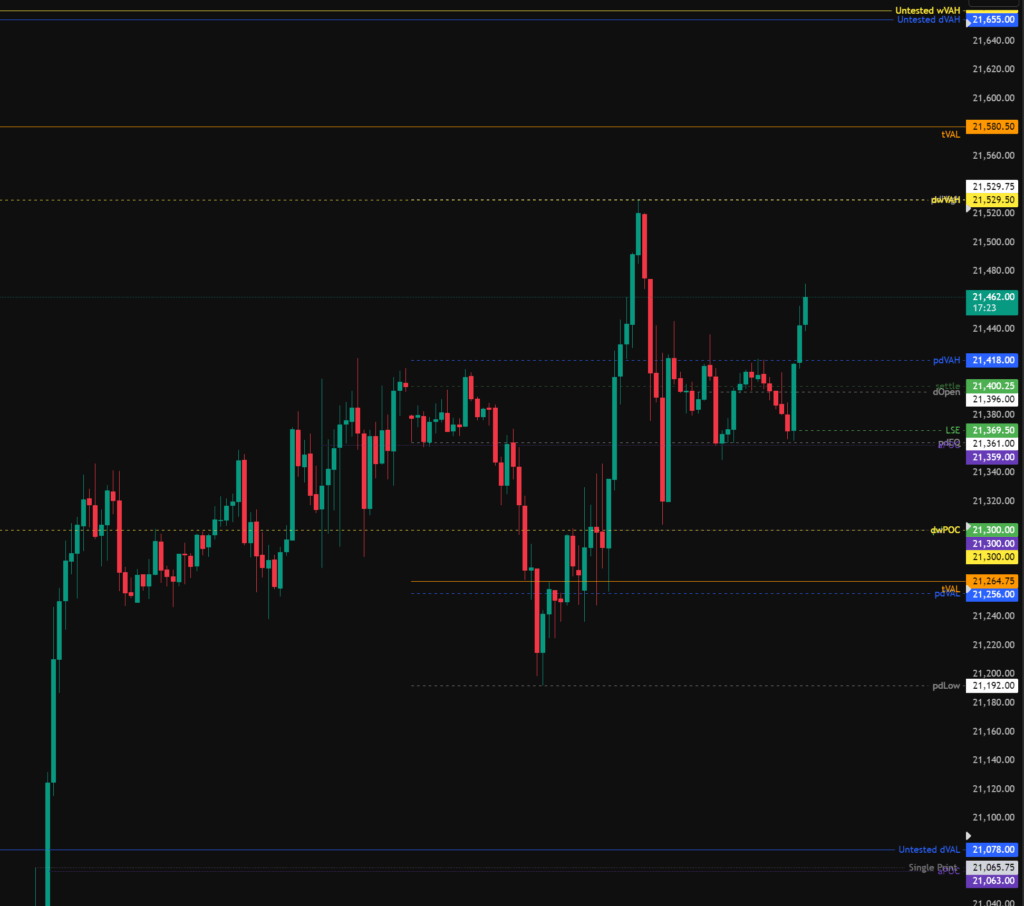

As we come to the end of another trading week reviewing the daily chart on the NQ futures shown below we can see the market is still trending upwards, while this is the case we should be focusing on long trades and going with momentum. However markets don’t go up for ever, so at some point in the future we should expect a pullback which could be viewed as another buying opportunity for the longer term portfolios.

Trading Plan

Today we should be focusing on going with the trend, which currently is upwards after a bullish London open. We have data releases coming out of the US at 13:30 GMT so tight risk management or closing down positions during this time is recommended.

Todays levels of support for the Nasdaq where price may, or may not give a reaction are:

- 21,360 – pdEQ in confluence with aPOC.

- 21,300 – Developing weekly POC, aPoc, pdPOC

- 21,256 – pdVAL,

- 21,078 – Untested value, single print, aPOC.

Todays levels of Resistance for the Nasdaq where price may, or may not give a reaction are:

- 21,665 – Untested weekly and daily value.

High Impact News events to be aware of:

- 13:30 GMT – Housing Starts, Building Permits, Michigan Consumer Sentiment.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.