In yesterdays ES technical analysis the market was in a downtrend during London due to the bearish news coming out of the USA over the weekend. The market found support at the 0.75% fib retracement and was quickly bought back up through London and into the NY session and this ended up being a minor pullback with was quickly bought up.

Going in to London session today we are again seeing a minor pullback which has currently found support on the previous month VAH on the futures.

Trading Plan

The S&P 500 is still in a uptrend and market structure remains bullish therefore its sensible to look for longs on pullbacks and enter any shorts with caution.

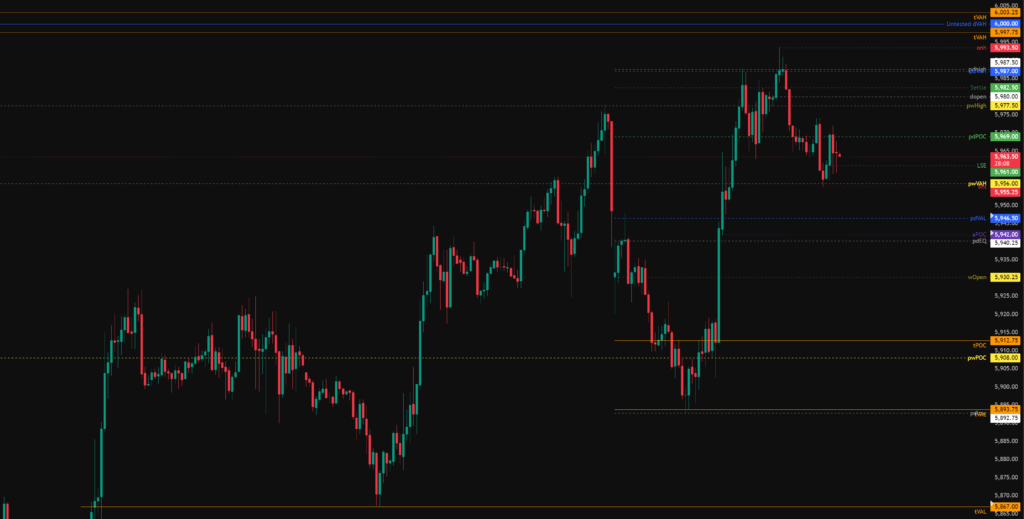

Todays levels of support on the S&P 500 where price may, or may not give a reaction are:

- 5,946 – pdVAL

- 5,940 – pdEQ, aPOC.

- 5,908 – pwPOC, tPOC.

- 5,856 – Previous week VAL, previous week EQ.

- 5,825 – aPOC, Untested VAL.

Todays levels of Resistance on the S&P 500 where price may, or may not give a reaction are:

- 6,000 – Untested Value.

- 6,012 – Untested Value

High Impact News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.