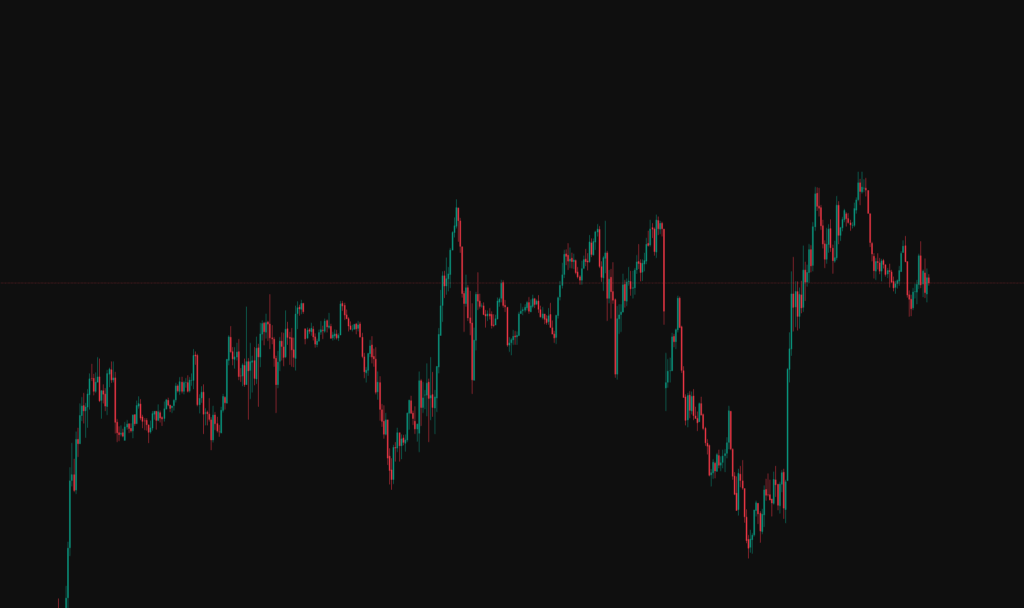

The NQ had a much deeper pullback compared to the ES yesterday, this however was quickly bought back up during the second half of the London session and in to NY.

We are again seeing some local weakness this morning during the London session, will we see a deeper pullback today or will the market find support and continue its bullish momentum.

Trading Plan

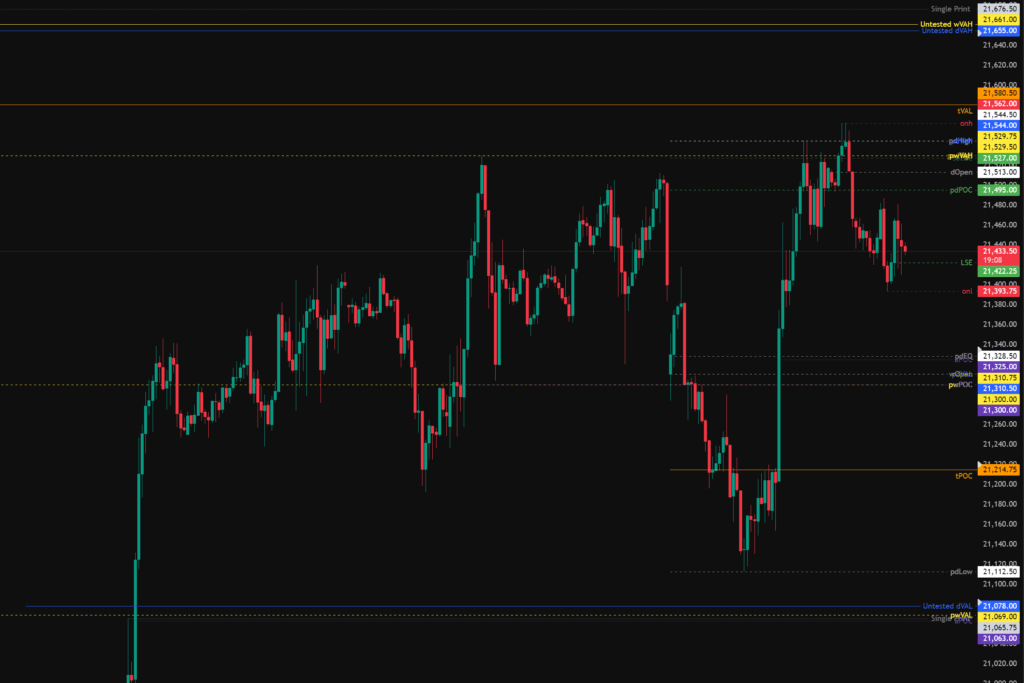

Today saw a daily open in the upper quartile of the pd day range, as per our statistics we can expect yesterdays high to be taken which has already happened during London session.

There are a number of areas of key support below with weaker resistance above, therefore we should put more weight on long trades being careful with any shorts.

Todays levels of support for the Nasdaq where price may, or may not give a reaction are:

- 21,328 – pdEQ, aPOC

- 21,300 – pwPOC, aPOC

- 21,214 – tPOC, S/R Zone

- 21,078 – Untested daily value, single print, aPOC, Previous Week VAL.

- 20,790 – Untested daily value, aPOC.

- 20,145 – Untested weekly value, gap fill.

Todays levels of Resistance for the Nasdaq where price may, or may not give a reaction are:

- 21,665 – Untested daily and weekly value.

- 21,790 – Monthly naked POC.

High Impact News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.