Yesterday saw a deeper pullback on the ES, looking at the below daily chart we can see a second daily bearish candle has been confirmed on the HTF.

A lower low has now been confirmed on the HTF, however price is currently at major support. We now need to be aware of a scenario where a lower high is formed followed by another lower low which would confirm a bearish market structure change on the higher time frame.

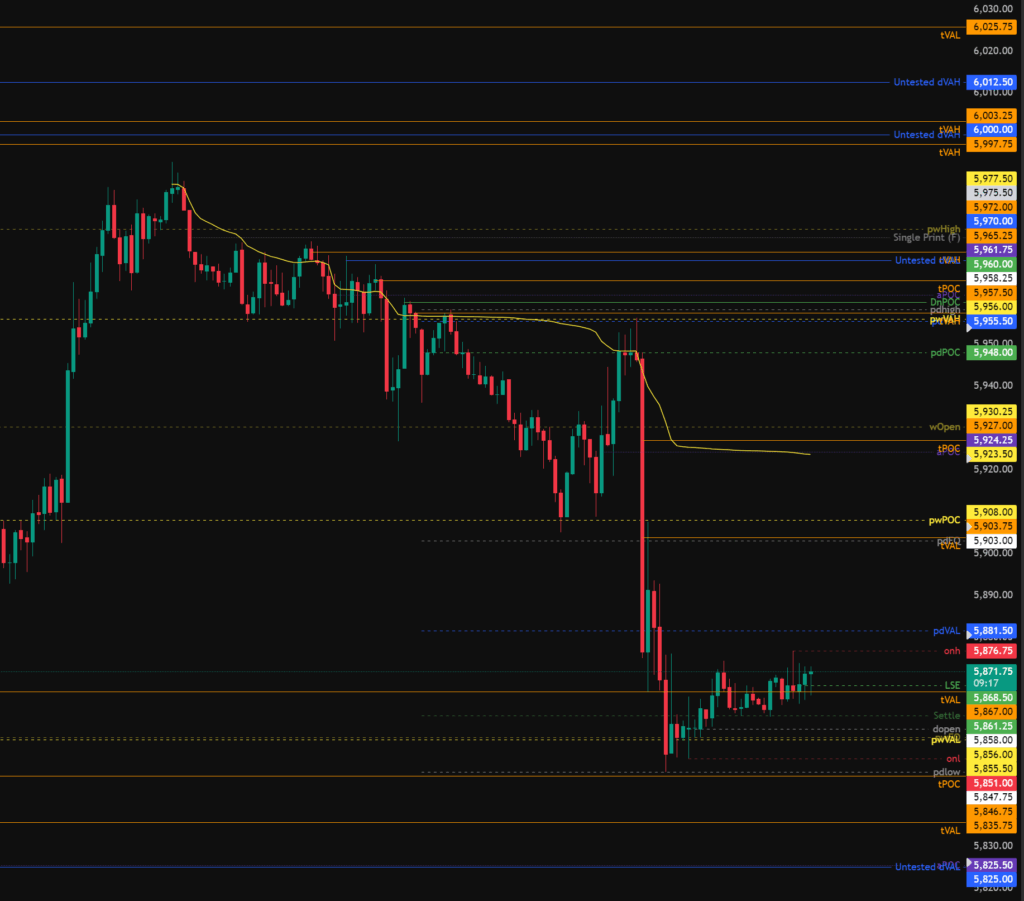

Yesterday we saw a full previous week value rotation, once price gained acceptance in to the previous week value area it travelled down to the previous week point of control for a bounce up to the previous week value area high for a rejection down to the previous week value are low.

Today we are seeing price with a bounce at the previous week value area low, therefore the first target would be previous week point of control followed by the previous week value area high to complete another weekly value rotation. However its important to note we have major data releases coming out of the US today which can quickly invalidate technical plans.

Trading Plan

Today we had an a daily open in the lower quartile of the previous day range, therefore based on our statistics we can expect the previous day low to be taken. We have also opened below the previous day VAL which could offer resistance should we reach that level. If we gain acceptance back in to the previous days value area then a value rotation up to the previous day value area high could be expected. Again, to reiterate data coming out of the US today could influence price therefore we need to be aware of both the bullish and bearish case.

Todays levels of support on the S&P 500 where price may, or may not give a reaction are:

- 5,946 – pdLow sweep, time point of control.

- 5,825 – aPOC, Untested VAL.

- 5,773 – Previous month high, single print fill.

- 5,865 – Gap close, weekly naked point of control, a session point of control.

Todays levels of Resistance on the S&P 500 where price may, or may not give a reaction are:

- 5,908 – Previous week point of control, pdEQ, time value area low.

- 5,924 – aPOC, tPOC, Weekly Open.

- 5,955 – pwVAH, pdVAH, DnPOC, aPOC, tPOC.

- 5,970 – Untested value, tVAH.

- 6,000 – Untested Value.

- 6,012 – Untested Value

High Impact News events to be aware of:

- 13:30 – US Jobless Claims, Continuing Jobless Claims, Initial Jobless Claims.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.