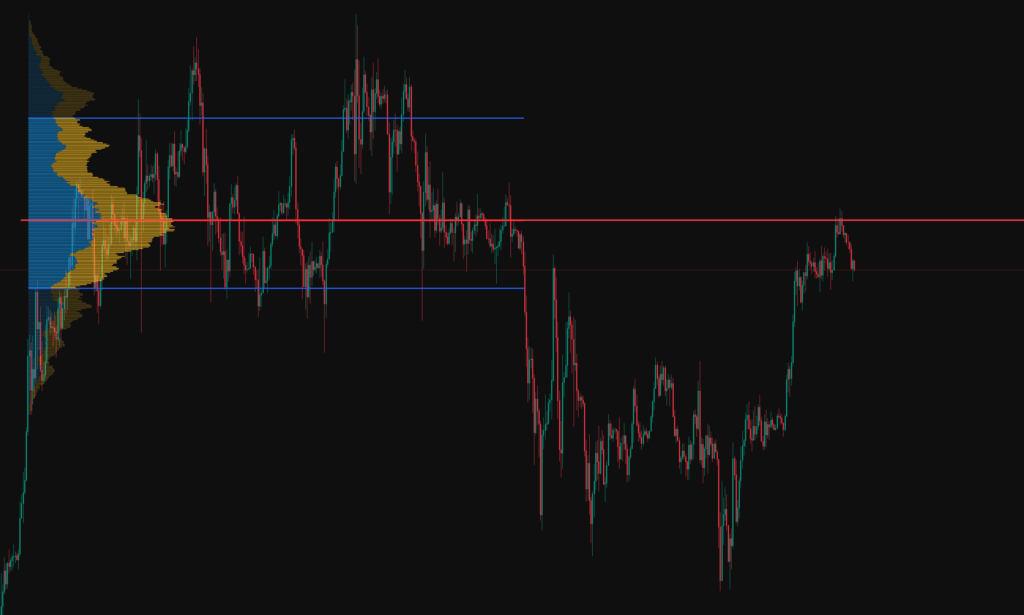

Bitcoin is continuing its bullish momentum to the upside and the anchored vWAP from the 20th April and local 0.66 fib is currently acting as support.

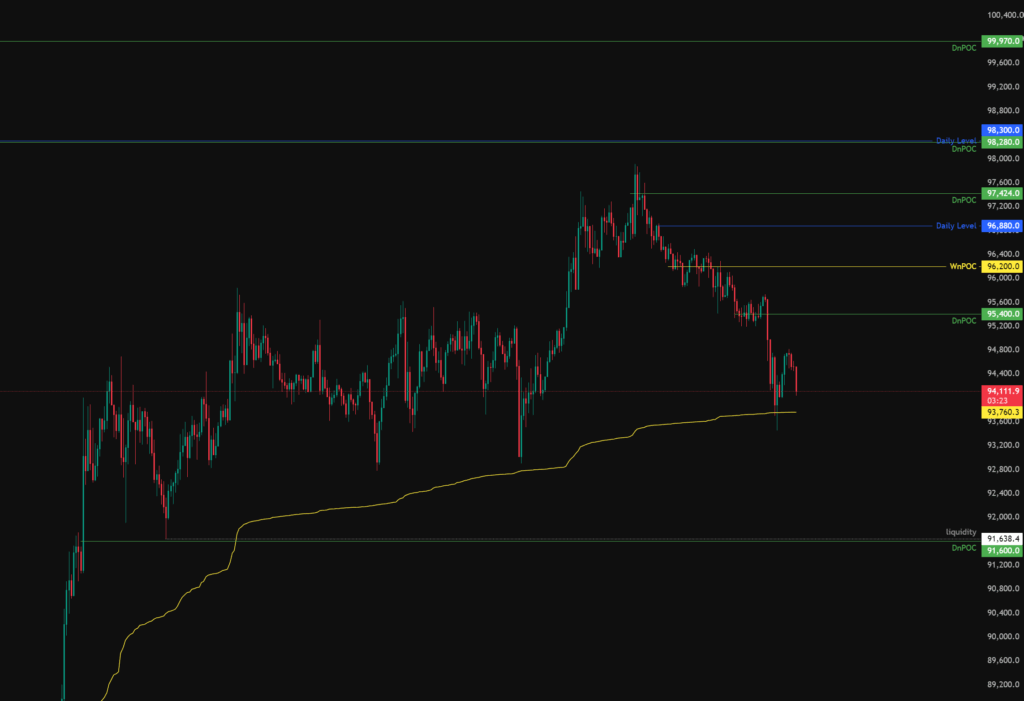

If we look at the below 8 hour chart on bitcoin it gives a higher time frame overview and we can see we are currently rejecting off the previous range point of control. The question is, will we see a larger retracement here or will Bitcoin find enough support and buying pressure to break the level.

Trading Plan

Todays levels of support where price may, or may not give a reaction are:

- 91,600 – dNPOC (Daily Naked Point of Control) in confluence with liquidity on the 24th April low.

- 85,100 to 83,600 – Zone containing wNPOC (Weekly Naked Point of Control), dNPOC (Daily Naked Point of Control) and Daily Level and 0.618 fib level.

- 82,500 – Monthly level, 0.66 fib and area of liquidity.

Todays levels of Resistance where price may, or may not give a reaction are:

- 98,300 – Daily Level, dNPOC (Daily Naked Point of Control), Liquidity of the local high and rejection of higher time frame POC.

News events to be aware of:

- 14:45 GMT – S&P Global Services PMI

- 15:00 GMT – ISM Services PMI

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.