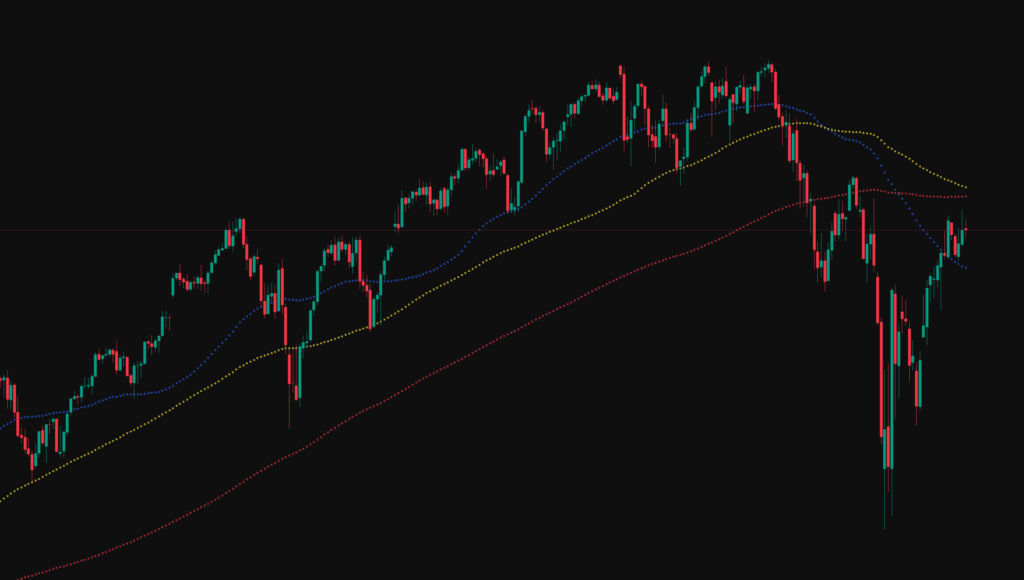

As a new trading week begins I would like to start by taking a higher time look at the charts. If we look at the below chart which is the weekly on the ES futures we can see price is currently finding resistance at the 50SMA. In order to see more upside we need to flip this level in to support.

If we switch to a daily view we can see the 50SMA has been claimed and up next we have resistance in the form of the 100 and 200 SMA’s.

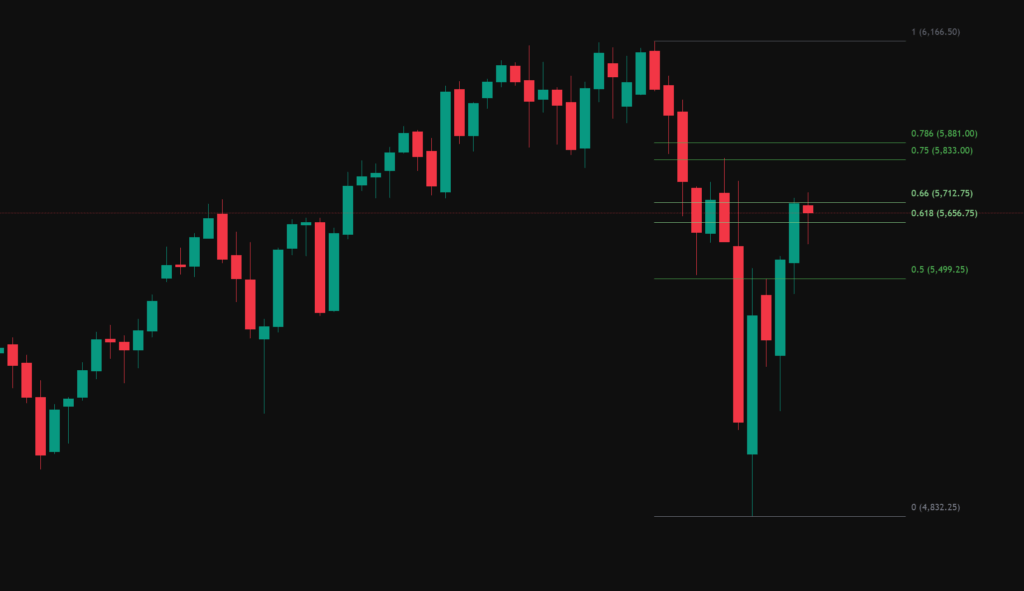

Pulling a fib from the ATH and swing low we can see price is currently also at the 0.66 retracement.

While the market has been in a clear bullish uptrend since the low put in on the 7th April we need to be mindful that the market could put in a lower high here and continue lower entering us in to a bear market.

Based on the market structure to date there is nothing to suggest this is about to happen but as a trader we should be aware of all scenarios.

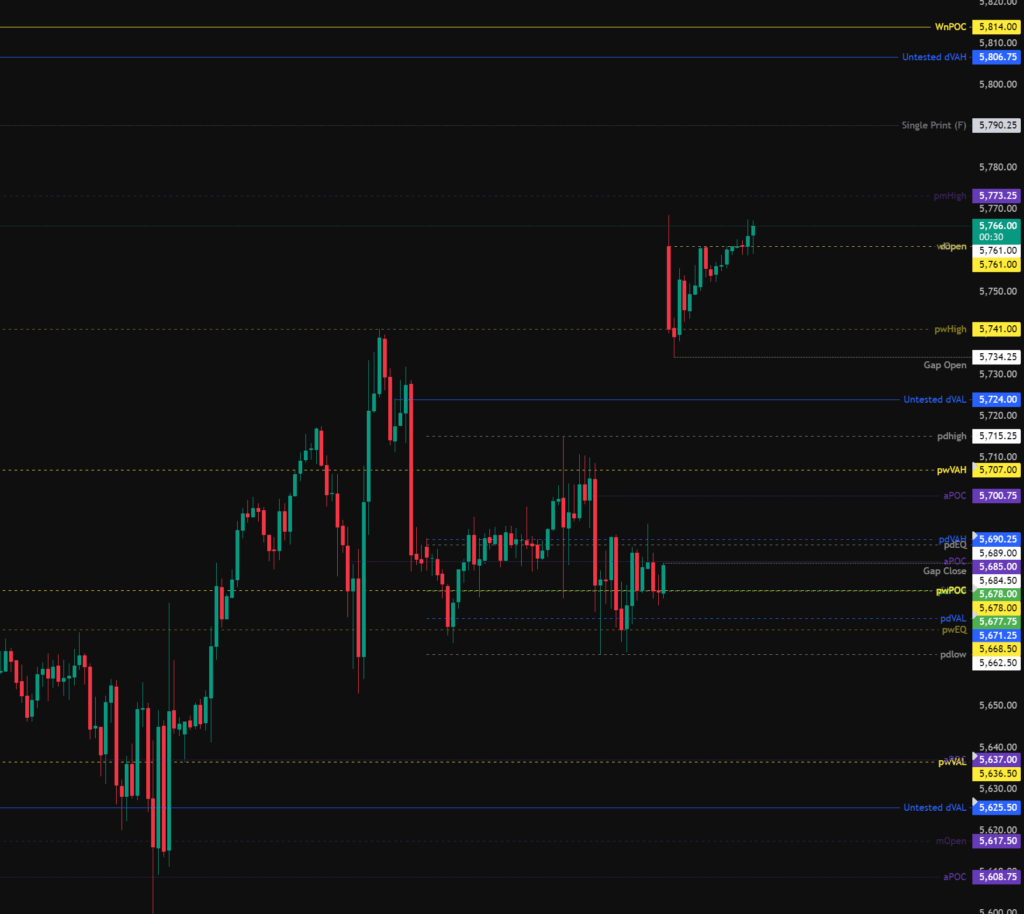

Trading Plan

The weekly and daily charts have opened with a large gap to the upside on China/US trade deal news. Tight risk management should be followed today as the market may be volatile.

Todays levels of support where price may, or may not give a reaction are:

- 5,707 – pwVAH.

- 5,690 – pdVAH, pdEQ in confluence with the 0.75 fib retracement.

- 5,678 – pwPOC and pdPOC.

- 5,671 – pdVAL and pwEQ.

- 5,662 – pdLow sweep in confluence with the 0.618 fib retracement.

- 5,637 – pwVAL, aPoc, 0.75 fib retracement.

Todays levels of Resistance where price may, or may not give a reaction are:

- 5,867-5,814 – Untested daily value and weekly naked point of control.

- 5,838 – Untested monthly value area high, single print, liquidity.

- 5,849 – Untested weekly value area high and single print.

- 5,868 – Untested daily value

- 5,902 – Untested daily value and single print fill.

High Impact News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.