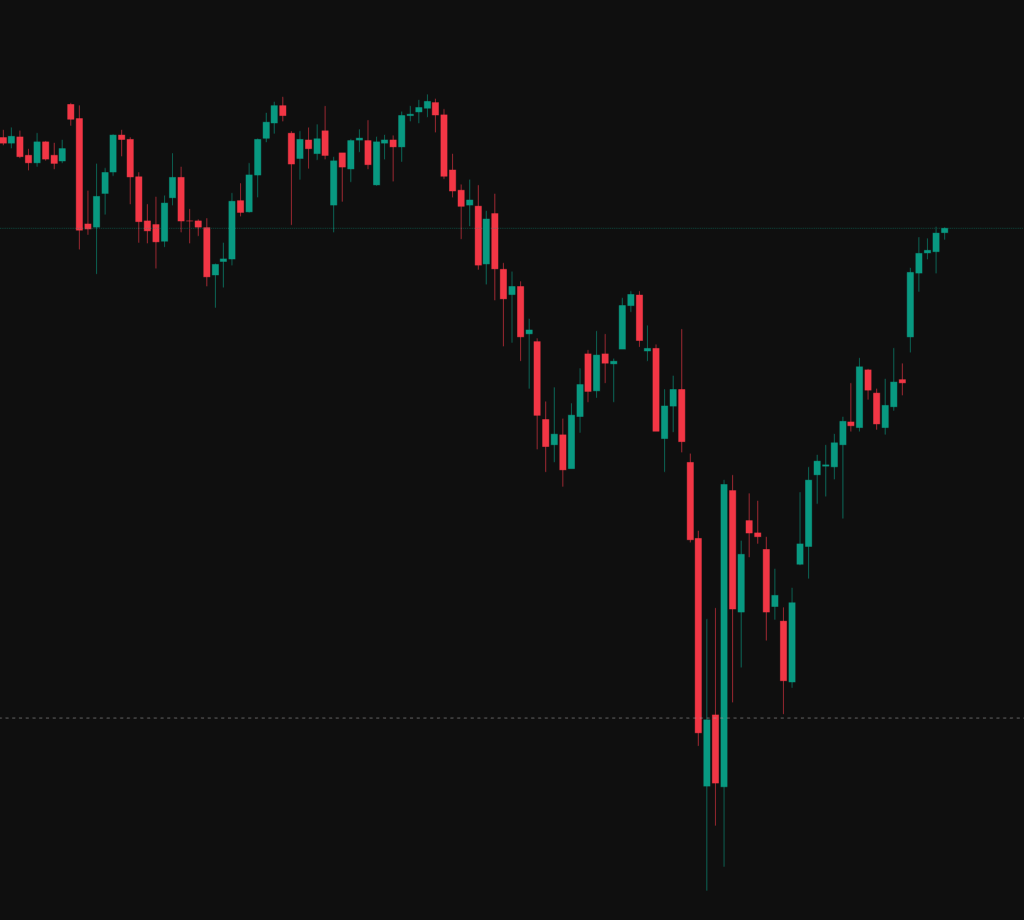

The below chart is a daily view of the S&P 500 (ES), we can see the market is still clearly in a very bullish uptrend and again we focus on longs. In yesterdays technical analysis for the ES we discussed the opening candle which was a impulsive bearish candle, with no upper wick and small gap down. This was a target for long trades and indeed this gap was close and candle repaired.

Trading Plan

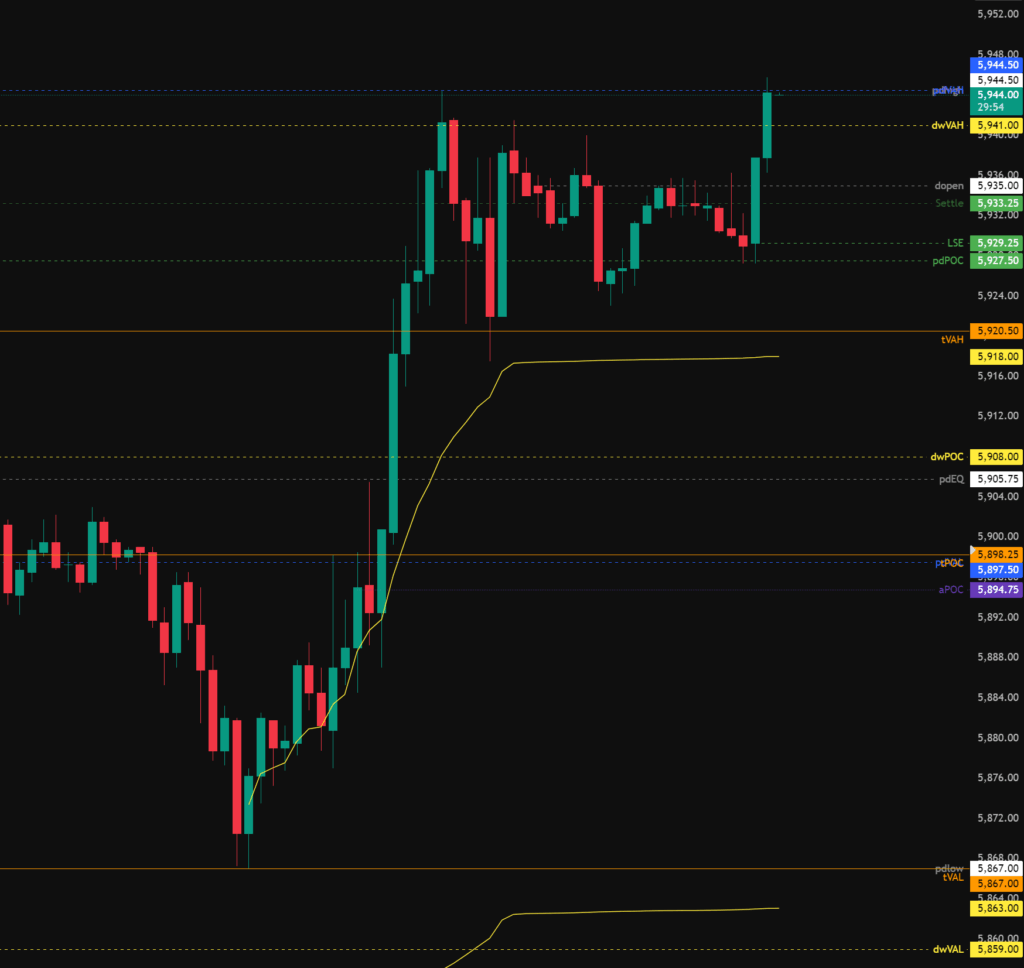

London session has opened bullish today with a move up in to the pdHigh and pdVAH, as mentioned above we should be focusing on long trades going with momentum and any shorts should be taken with caution with quick take profits and tight risk management.

Todays levels of support on the S&P 500 where price may, or may not give a reaction are:

- 5,820 – Time value area high, with anchored vWAP which is moving up to be in confluence.

- 5,905 – Developing week POC in confluence with the pdEQ.

- 5,897 – Time pOC, pdVAL, aPoc.

- 5,867 – Time VAL, pdLow, aWVAP.

- 5,825 – aPOC, Untested VAL.

Todays levels of Resistance on the S&P 500 where price may, or may not give a reaction are:

- 5,956 – Naked POC.

- 6,000 – Untested Value.

High Impact News events to be aware of:

- 13:30 GMT – Housing Starts, Building Permits, Michigan Consumer Sentiment.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.