As we begin a new week we are starting with a local pullback on the ES on bearish news coming out of the US over the weekend. Looking at the daily chart below we can see the pullback is minor at this stage and overall on the HTF market structure is still very bullish.

Trading Plan

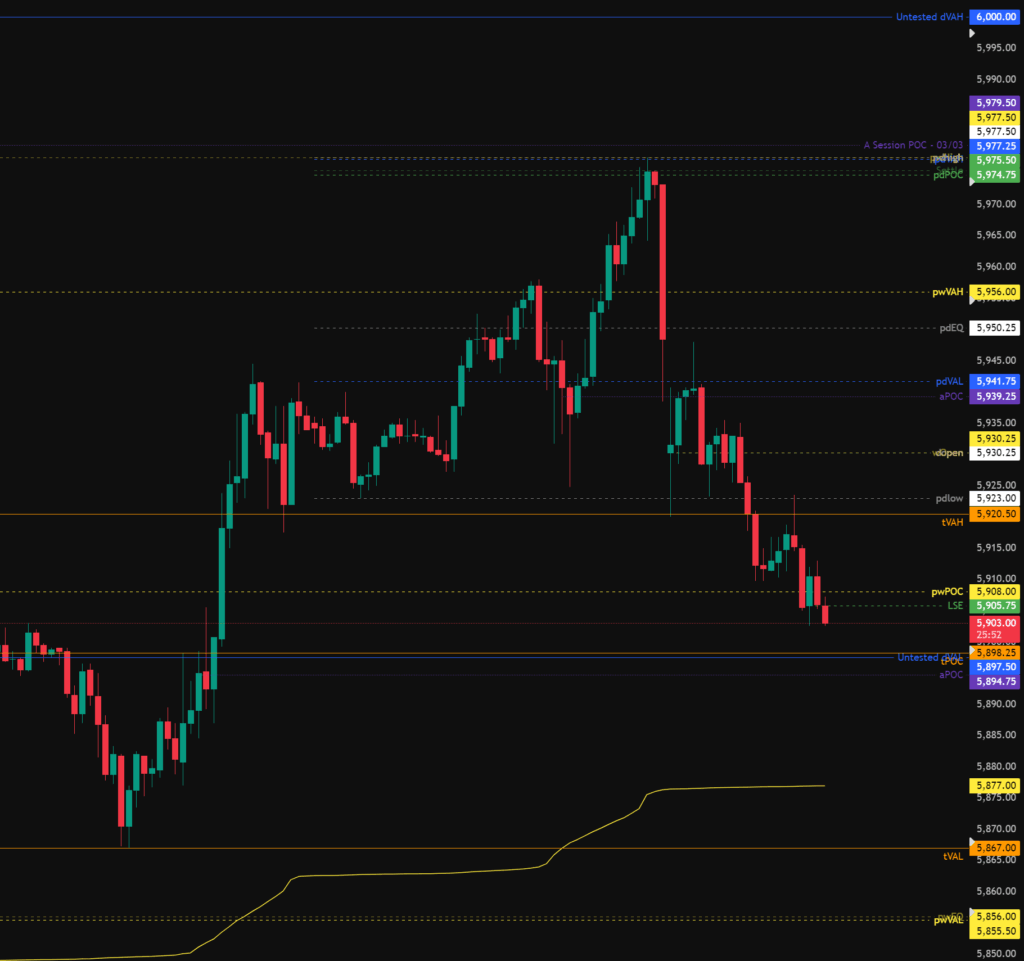

The overnight session so far has been bearish however ES is starting to arrive at areas of support, the question is will these areas hold or will price continue lower for a larger pullback.

Todays levels of support on the S&P 500 where price may, or may not give a reaction are:

- 5,897 – Time POC, Untested VAL, aPoc, 0.75 fib.

- 5,867 – Time VAL, liquidity

- 5,856 – Previous week VAL, previous week EQ.

- 5,825 – aPOC, Untested VAL.

Todays levels of Resistance on the S&P 500 where price may, or may not give a reaction are:

- 5,956 – Previous week VAH, Local 0.75 fib area.

- 5,977 – PdPOC, Settlement, PW/PD high, pdVAH, aPOC.

- 6,000 – Untested Value.

High Impact News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.