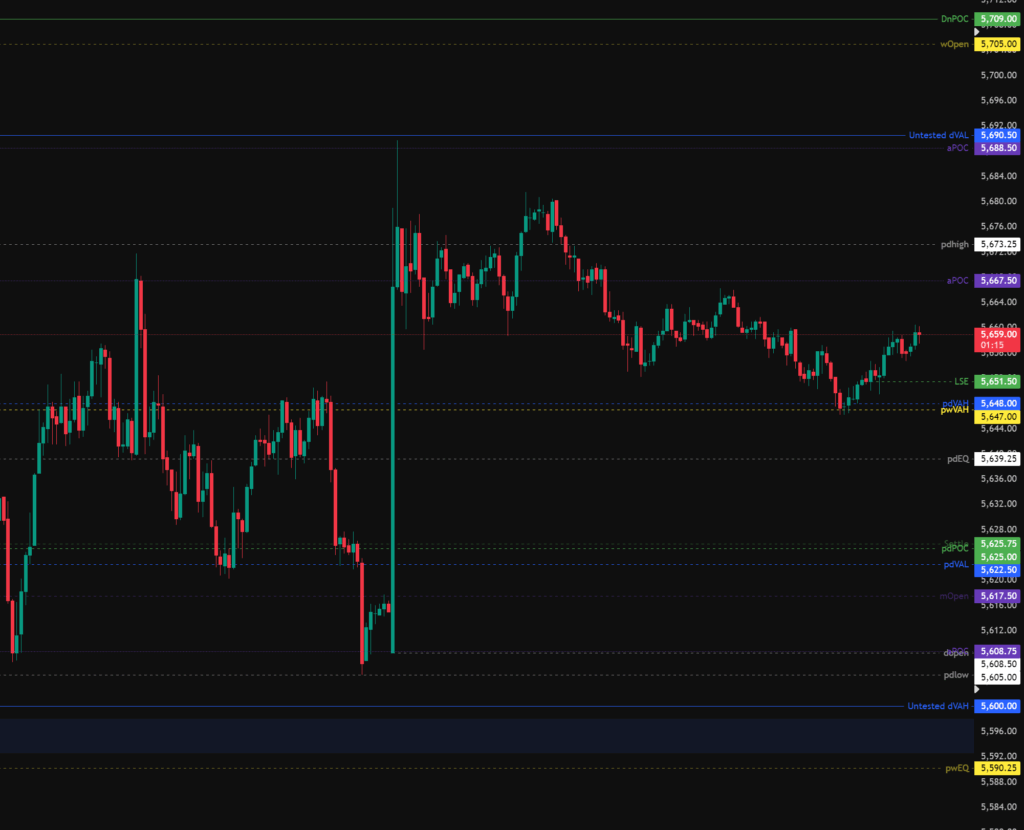

Today the ES opened with a strong impulsive candle to the upside which have currently retraced to the 50% level during London session in confluence with the pdVAH and pwVAH currently acting as support.

Today we have FOMC therefore any trades taken should be with tight risk management and also be mindful that price action may be choppy and levels may not get the respect they normally do.

Trading Plan

The weekly opened in the upper quartile of the previous weeks range, therefore statistically speaking a new weekly high could be expected this week.

The daily opened in the lower quartile of the previous days price range therefore statistically speaking a new low could be expected today. However the market opened with a bullish impulsive candle and we have FOMC so we should not place to much importance on statistics today.

Todays levels of support where price may, or may not give a reaction are:

- 5,622 – pdVAL, pdPOC, Settle and 0.786 retracement.

- 5,600 – Untested Value, Liquidity grab and SR (Support Resistance) Flip from 29th April.

- 5,550 – pwPOC and 0.66 Fib retracement.

Todays levels of Resistance where price may, or may not give a reaction are:

- 5,690 – Untested Value, aPoc, Liquidity grab of local high.

- 5,721 – Untested value, pwHigh

- 5,739 – Untested weekly value.

News events to be aware of:

- 19:00 GMT – FED Interest Rate Decision.

- 19:30 GMT – FED Press Conference.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.