Yesterday ES retraced the bullish opening candle, took pdLow and the liquidity at the range lows. We can now conclude the lows are complete and if we are expecting further upside there is now no reason to revisit the lows.

Given the context we can now look towards the highs being taken and put preference in to longing any pullbacks to areas of support.

Trading Plan

The monthly opened in the upper quartile of the previous months range, therefore statistically speaking a new monthly high could be expected this month.

The weekly opened in the upper quartile of the previous weeks range, therefore statistically speaking a new weekly high could be expected this week.

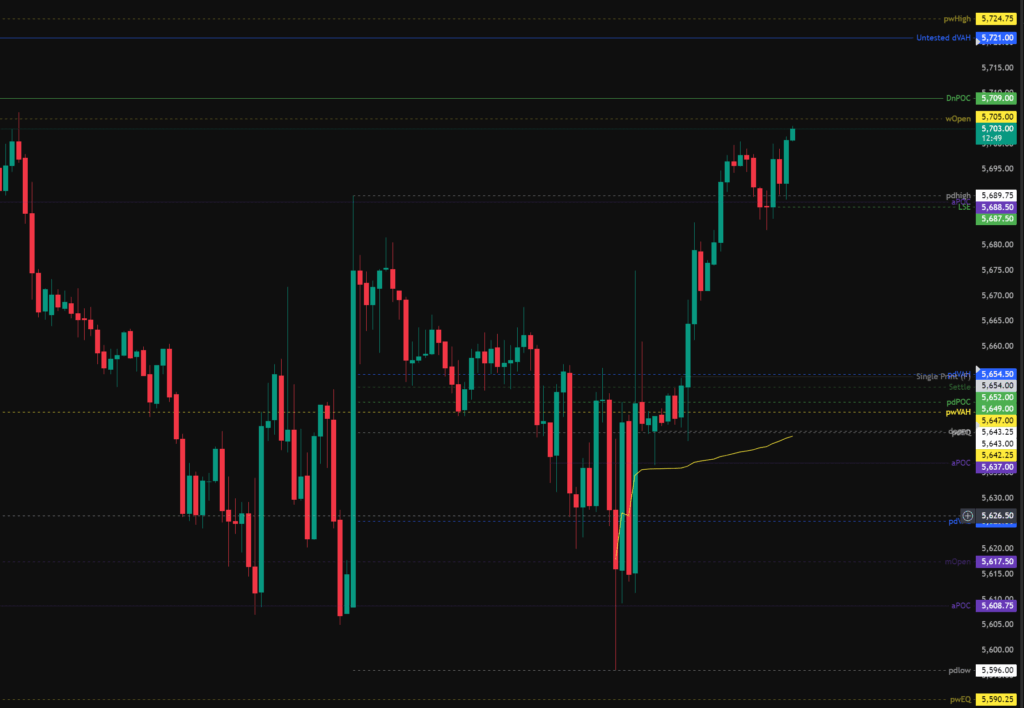

On the daily time frame, price opened within previous day balance, has taken the pdHigh and is now building value about pdVAH.

Todays levels of support where price may, or may not give a reaction are:

- 5,654 – pdVAH, Single Print fill.

- 5,643 – dOpen, pdEQ, pwVAH, anchored vWAP from yesterdays low.

- 5,625 – pdVAL.

- 5,550 – pwPOC and 0.66 Fib retracement.

Todays levels of Resistance where price may, or may not give a reaction are:

- 5,721 – Untested value, pwHigh, range high liquidity.

- 5,739 – Untested weekly value.

News events to be aware of:

- 13:30 GMT – Jobless Data.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.