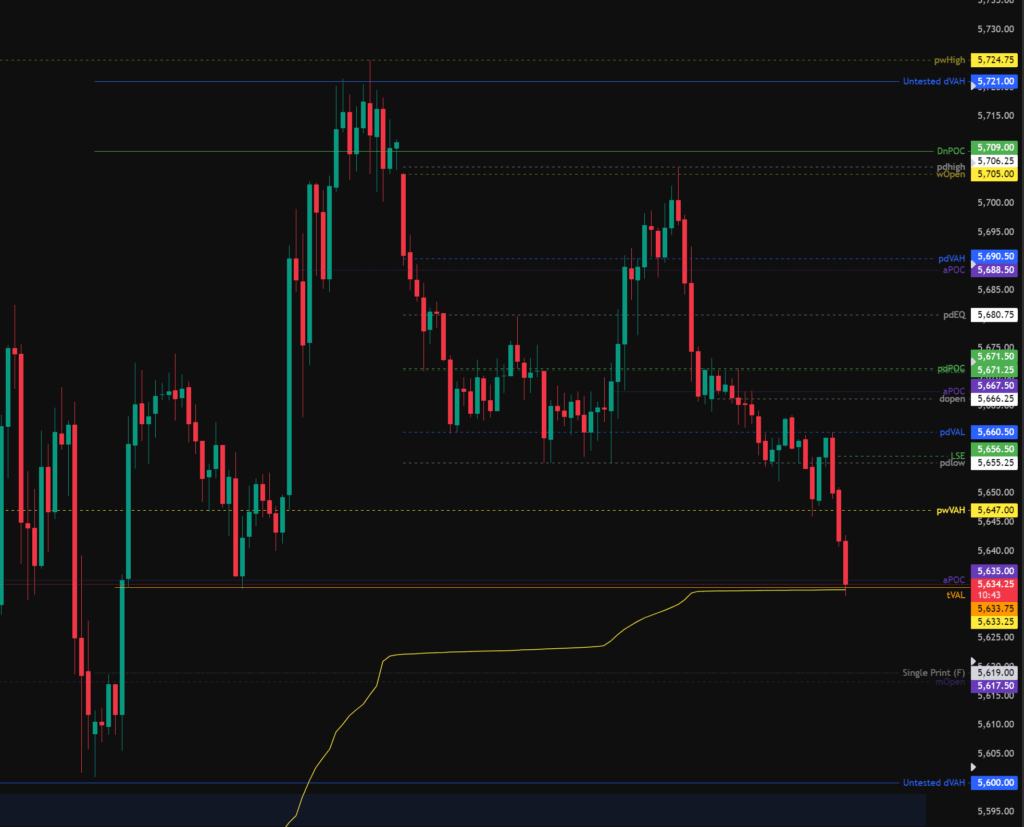

From the below 30m chart we can see the ES has been down trending since the daily open with the pwVAH giving a small reaction.

On the higher time frame charts market structure is sill bullish, however we need to be aware of FOMC tomorrow (Wednesday 7th May 2025) and this data is likely to influence price direction.

Trading Plan

The weekly opened in the upper quartile of the previous weeks range, therefore statistically speaking a new weekly high could be expected this week.

The daily opened in the lower quartile of the previous days price range and the previous days low has already been taken as we would expect as per statistical analysis.

Price is now trading within the pwVA, if price continues to trade under the pwVAH then this could be seen as acceptance and we could expect a test of the pwPOC.

Todays levels of support where price may, or may not give a reaction are:

- 5,619 – mOpen (Monthly Open) and Single print fill.

- 5,600 – Untested Value, Liquidity grab and SR (Support Resistance) Flip from 29th April.

- 5,550 – pwPOC and 0.66 Fib retracement.

Todays levels of Resistance where price may, or may not give a reaction are:

- 5,671 – pdPOC, Settlement, Monthly vWAP.

- 5,790 – pdVAH, 5m Support resistance zone.

- 5.709 – wOpen, pdHigh SFP in to untested daily naked POC.

News events to be aware of:

- None.

The above levels are intended as areas of interest only, they are not in anyway financial advice and a valid entry trigger, stop loss placement and target needs to be considered before entering any position.