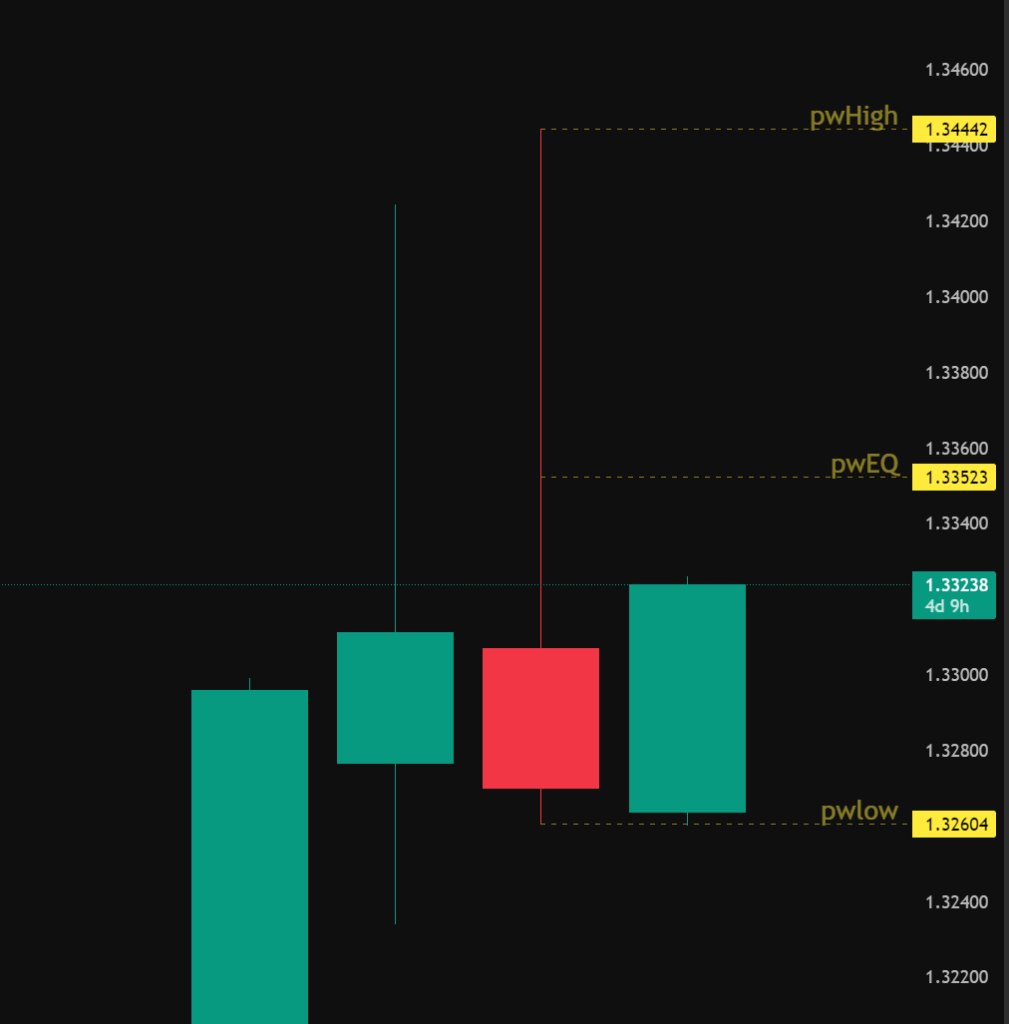

In the whirlwind of daily trading, it’s easy to get caught up in the minute-to-minute fluctuations. But sometimes, stepping back and looking at the bigger picture can reveal powerful insights. Just like the previous day’s high, low, and equilibrium offer clues, their weekly counterparts – the Previous Week High (PWH), Previous Week Low (PWL), and Previous Week Equilibrium – paint a broader narrative of market sentiment and can be invaluable in shaping your trading strategy.

Think of the past week as a complete chapter in the market’s ongoing story. The PWH marks the highest point of bullish conviction during that period, the level where buyers exerted maximum upward pressure. Conversely, the PWL represents the deepest dip of bearish influence, the point where sellers held sway or buyers finally stepped in with force.

Finding the Balance: The Previous Week Equilibrium

Similar to the daily equilibrium, the Previous Week Equilibrium aims to identify the area of relative balance between buyers and sellers over the entire week. Common calculations include:

- Weekly Midpoint: The simple average of the PWH and PWL: PWH+PWL / 2

- Weekly VWAP: The volume-weighted average price across all trading days of the previous week, providing a more volume-centric view of the “fair” price.

- Weekly Point of Control (POC): The price level where the highest volume of trading occurred throughout the entire previous week.

This weekly equilibrium can act as a significant reference point for the current week’s trading. Price may gravitate towards it as traders assess the longer-term value and direction.

Unlocking Strategic Advantages with Weekly Levels:

So, how can these weekly landmarks become useful tools in your trading arsenal? Here are some unique ways to incorporate them:

- Identifying Broader Trend Bias: A sustained break above the PWH could suggest increasing bullish momentum on a slightly longer timeframe, potentially favoring long positions. Conversely, a consistent break below the PWL might signal growing bearish sentiment, leaning towards short opportunities.

- Swing Trading Entry Points: The PWL can act as a potential area of support for swing traders looking to enter long positions, anticipating a bounce based on the previous week’s buying interest. Similarly, the PWH might serve as resistance for short entries, expecting sellers to defend the previous high.

- Confirmation for Daily Setups: If you have a daily trading setup that aligns with a weekly level, it can add significant confluence to your trade. For example, if a daily breakout occurs near the PWH, it strengthens the case for a potential continuation.

- Managing Risk on Longer Timeframes: Placing stop-loss orders beyond the PWH or PWL can provide a wider buffer against short-term volatility, aligning your risk management with the weekly price range.

- Understanding Institutional Activity: Weekly highs and lows can sometimes reflect institutional buying or selling pressure that played out over the entire week. Observing how price interacts with these levels in the current week can offer clues about continued institutional interest.

- Anticipating Range Expansion or Contraction: A narrow range between the PWH and PWL might suggest a period of consolidation, potentially followed by a significant breakout in either direction. Conversely, a wide weekly range indicates high volatility, which can influence your position sizing and risk management.

- Combining with Monthly Levels: For an even broader perspective, consider how the weekly levels interact with the previous month’s high, low, and equilibrium. Confluence across multiple timeframes can highlight particularly significant areas of potential support or resistance.

Key Considerations for Weekly Analysis:

- Time Sensitivity: The relevance of the previous week’s levels can diminish as more time passes. Focus primarily on the immediate week following their formation.

- Market Events: Major news events or economic releases that occurred during the previous week can significantly influence the significance of the PWH and PWL.

- Volume Analysis: Always consider the volume traded at these weekly levels. High volume breakouts or reversals tend to be more significant.

Beyond the Daily Noise:

Incorporating the Previous Week High, Low, and Equilibrium into your analysis encourages a more holistic view of market action. It helps you filter out some of the daily noise and identify key levels that have proven to be significant over a longer period. By understanding the story the market told last week, you can gain a valuable edge in anticipating its potential moves in the current one, leading to more informed and strategic trading decisions. So, take a step back, look at the weekly chart, and uncover the insights hidden within last week’s narrative.